Interim property tax bills are sent out in March. Each bill has two instalments that are due.

- Interim installment 1 is due March 31, 2025

- Interim installment 2 is due May 30, 2025

This website uses cookies to enhance usability and provide you with a more personal experience. By using this website, you agree to our use of cookies as explained in our Privacy Policy.

Property taxes are billed by the City twice per year: the interim bill and the final bill. There are two instalments due for each billing. All payments must be received by the due date to avoid late payment charges. Penalties of 1.25% will be added to unpaid taxes on the first day of the month following the due date, and the first day of each month thereafter. The tax collector has no authority to waive penalties/interest charges for any reason.

Register below to receive your bills by email.

Interim bill: mailed out in March each year

Interim property tax bills are sent out in March. Each bill has two instalments that are due.

Final bill: mailed out in August each year

Final property tax bills are sent out in August. Each bill has two installments that are due.

For more detailed information, please visit the Payment Options section of our website.

To learn more about the breakdown of where your taxes go based on your property tax class and your assessment value, use our Property Tax Calculator.

Please provide any mailing address changes or corrections in writing along with your payment. If the property has changed ownership, please return the tax bill to the City.

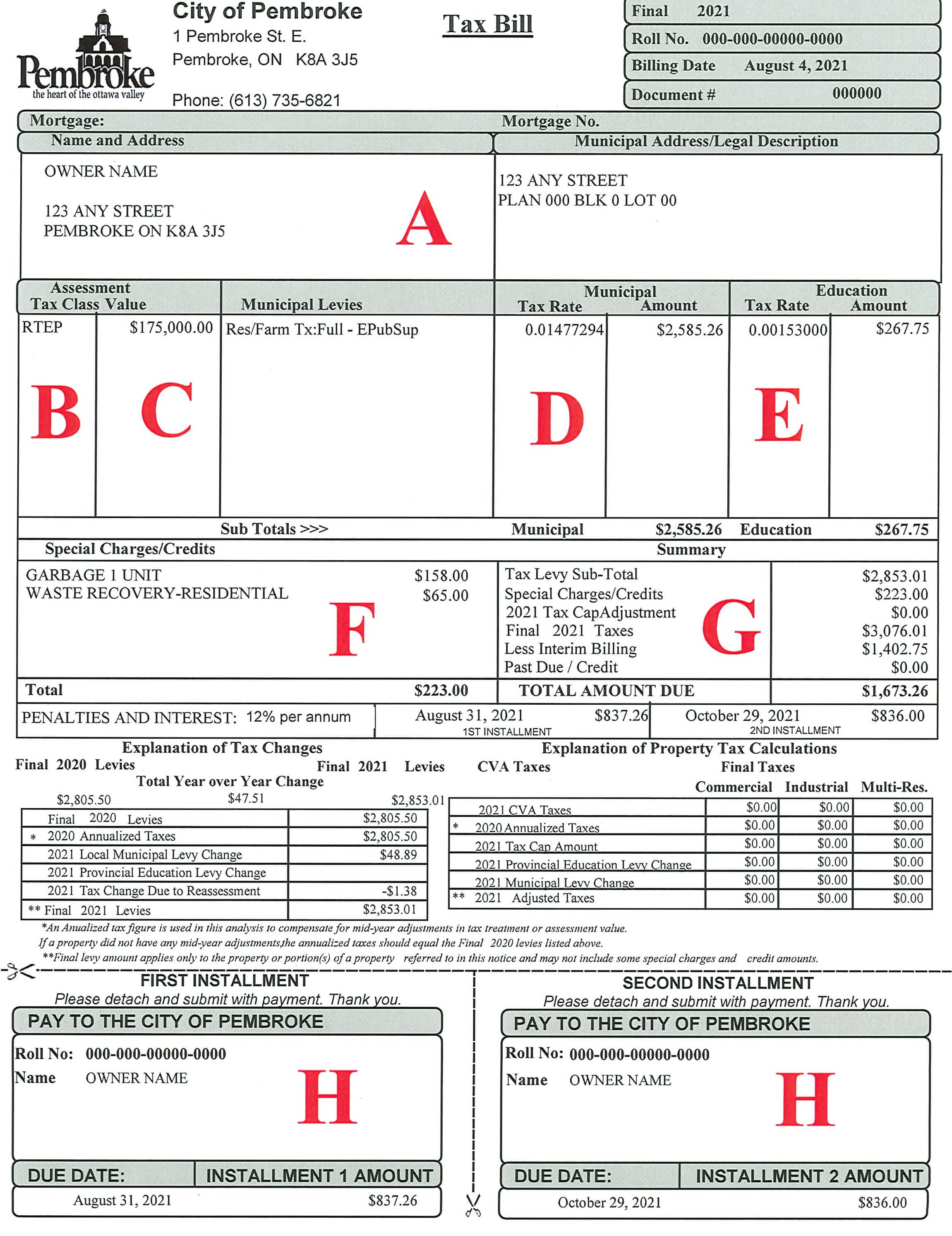

This contains identification information such as municipal tax roll number, mailing address, and a legal description of your property.

This section lists the classification of your property (i.e., residential, farm, commercial) and educational support. If you have questions about education support, call the Municipal Property Assessment Corporation at 1-866-296-6722. You can also visit their website at mpac.ca.

This shows the current assessed value of your property, as determined by the Municipal Property Assessment Corporation. For more information on how properties are assessed, please visit mpac.ca

D: Municipal and area rate levies

This section provides a detailed breakdown of your property taxes as set by City Council. To determine the amount of tax you pay for each service, multiply the tax rate for that service by the assessed value for your property.

The education tax is set by the provincial government. To determine the amount of education tax that you pay, multiply the education tax rate by the assessed value of your property.

F: Special charges and credits

This section lists charges that are specific to your property. Special charges cover a range of services including garbage and waste charges and other local improvements.

This section lists the subtotals of your tax levy (municipal and education), tax cap (no longer applicable), and any credits or special charges.

Property taxes are billed twice per year, the interim bill and the final bill. Each bill has two installments, which is why there are two stubs at the bottom of each bill. Each stub has a due date with the amount due.

You need to submit payment stubs along with your payment when you pay by mail, in person, or at a financial institution. If you pay through a pre-authorized plan, you do not need to submit either of the stubs.

| Tax code | Municipal | Education | Total |

|---|---|---|---|

|

Residential (RT) |

0.01826203 |

0.00153000 |

0.01979203 |

|

Multi-Residential (MT) |

0.03542461 |

0.00153000 |

0.03695461 |

|

Multi-Residential New Construction (NT) |

0.02008823 |

0.00153000 |

0.02161823 |

|

Commercial (CT CU CX ST SU DT XT XU) |

0.03615882 |

0.00880000 |

0.04495882 |

|

Industrial (IT IU IX JT JU LT) |

0.04802914 |

0.00880000 |

0.05682914 |

|

Pipelines (PT) |

0.02998691 |

0.00880000 |

0.03878691 |

|

Farmlands (FT) |

0.00456551 |

0.00038250 |

0.00494801 |

|

Pembroke Business Improvement Area (PBIA) |

|

|

0.00753399 |

Parents or ratepayers can request a change of their current school support. You would be required to go to the school board you would like to support to complete a form.

The school boards in the area are:

Note: Please call before ordering as not all properties are billed taxes by the City of Pembroke.

The fee is $60 and must be paid by cheque.

The cost of Tax certificates will be increasing on March 1, 2026 to $63

You can email your request to ebilling@pembroke.ca or send by mail to:

City of Pembroke

1 Pembroke St. E.

Pembroke, ON K8A 3J5

Contact Us